Why Joseph Stiglitz Agrees with Steve Jobs: How the Game Business Taught Apple to Run iTunes Edition

"We do not see the world as it is. We see the world as we are."

— Talmud

The time between posts seems to be increasing and as you may notice, if you make it through this one, I’m a bit of practice when it comes to brevity. I started this about two weeks ago and have been thinking about it a lot. It kinds of goes off on a tangent that has very little to do with games, so in the spirit of this blog, I’ll let you know, I am playing Arkham Asylum right now and loving it. I think it’s not just because I am huge Batman fan and have been waiting for a good Batman game either. It really is great.

And now for something completely different.

The blogosphere is alight with stories of Apple’s anti competitive behavior. We’ve gone down the typical path of Apple is great, to Apple isn’t nice, to Apple is anti competitive, to Apple is Satan incarnate to your mother sleeps with goats. All of the discussion arises from Apple’s continued to decision to control the content distributed through it’s iTunes store – dare I say, a model cribbed from games. The very model which, when employed, allowed our business to rise like a phoenix from the ashes of unsold ET carts to 15% annual growth since 1988 – or as I like to think a locomotive. Those of us in the game business look at iTunes and the app store and say “OK” and start building and submitting. I suppose they may look at us as suffering from some sort of Stockholm Syndrome, and if we are, we really wouldn’t know.The rest of the world sees the trappings of an evil empire bent on world domination and control through a software application used by less than one sixth of the market. In reality Apple, as a platform operator, is highlighting the value of a shift from Adam Smith’s “invisible hand” to a Keynesian monitoring of the market. They are showing they were not wrong when the kept the platform closed, just too early, and today we are seeing a fundamental philosophical change. Technology companies have traditionally believed open is better and point to Wintel v. Apple in the 90’s as the classic example. But when mainstream consumers are thrown into the mix, Apple is showing us closed – or should is say semi permeable – is the way to go.

It’s kind of weird to think of Apple in a position to leverage market share. Especially when even their product with the largest market share cannot control artists. For those of you who feel Apple has the power to make or break content, or exert control of speech, you need look no further than rock legend, partner in the private equity firm with a large stake in Palm, owner of the only of eponymous iPod and current Blackberry shill:

U2 was able to use Apple to sell its music and when a higher bidder came along they went elsewhere. I am sure Steve Jobs is not happy about it, but so far, U2 is not sitting hungry in the street - and this all occurred in a market where Apple does have a majority share – of a market segment. While Apple has 69% of the digital music market sales, this percentage represents only 25% of the overall market http://www.businessinsider.com/itunes-now-25-of-all-music-sold-2009-8. Sure it’s a large number, but is less than a third of the CD market which continues to hold 65% of overall sales, and not enough to “control” significant player.

But the most recent arguments don’t stem from a dominant position in the music market, they come from a place where Apple is a growing, hip device, but still merely a bit flashy bit player. Anticompetitive behavior is actionable when a company has significant market power and Apple just doesn’t have it. People may think it does, because the company’s ability to secure press belies their market share. Their 13.3% share of the smartphone market is growing but still significantly smaller than to Nokia's 45% and smaller than RIM at 18%. It is really tough to leverage 13% market share all contained on a single carrier in each territory against all others in an anticompetitive manner. This is probably why the blogs did not start with anticompetitive accusations. It only got there after all the facts were stripped from the story.

The torch was lit when Apple rejected the Google Voice app. Michael Arrington posted why the lack of google voice caused him to drop the iphone. Arrington's meticulously researched blog is a fantastic resource for anyone interested in tech startups or businesses in general, so his posts often pique readers' interest. Some accused him of shilling for google based on their unique provision of voice portability, but Arrington disclosed his access in the first post. He described the feature set and really had nothing else to say about Apple than he chose a competitive product more suited to his needs. The coverage should have stopped there. Arrington didn’t like the product, he had other options, and he took one. But the coverage didn't stop there. Popular gadget blog Gizmodo (when do so many professional journalists work on a blog that it is no longer a blog?) used the post to plant the meme that Apple's App review process is "inexcusable, and. . . not going to work in the long term." In non-sequitur worthy of Fox News, they leveraged "this product does not offer the applications I need, so it loses my support and I am choosing another," into "this single application highlights the shortcomings of a closed ecosystem." This turn in the discussion led to debate over the long-term viability of Apple’s closed system and how the closed system is, by its nature, evil.

Arrington's sometimes partner, gadfly and founder of Mahalo (the human edited search engine populated by content hand selected by its employees, or “closed system”) went the "your mother's a whore route." Stories like this circulate around Jobs and show up in books all the time, but the sucker for Apple that I am, I clicked through to find a link to a post by Jason Calacanis. Calacanis is a master

attention getter and he certainly did it with this poorly crafted argument, but he is smart enough to write intelligently - and should have. Shockingly, or not, he was surprised to find "the 10 percent [of respondents] who are 'fan boys' are attacking me personally in a vicious fashion. Luckily their mothers won't let them leave the basement to come to my house to egg my Tesla" when he initiated personal attacks when he said "Steve Jobs is on the cusp of devolving from the visionary radical we all love to a sad, old hypocrite and control freak–a sellout of epic proportions" and "Steve Jobs gets a pass because we are all enabling him to be a jerk. We buy the products and we say nothing when our rights are stripped away." What Calacanis does to his Tesla in the privacy of his own home is not really my concern, but if he wants Mac addicts to leave him alone, he should not swing the ball on the Newton's Cradle.

Even stripping away the personal attacks and vitriol, Calacanis' arguments fall flat. He took Arrington’s argument and expanded from “I am no longer going to use this product and the company’s closed system will cause it to lose customers” to “the company’s closed system is anticompetitive.” His talk of anticompetitive behavior and monopolistic practices have the credibility of Hilary Clinton's citation of right wing conspiracies targeting Bill Clinton when confronted with the Lewinsky allegations. Unfortunately, Calacanis’ equation of closed and anticompetitive received wide coverage, when in fact, the two concepts are, in this case, not at all related. If he really wants to understand anticompetitive behavior, he should take a look at Google, the company he is supporting.

At the beginning of the year Google had a 76% market share of on line ads. If you were not on adsense, you did not make money and could not sell ads. According to Google:

All publishers are reviewed for policy compliance when they submit their application. Also, we actively monitor sites in Google AdSense to check for continued compliance with our policies. If we find sites that do not comply with our policies or Terms and Conditions, we will suspend or terminate the accounts. In some cases, payment for clicks may be refused.

One of these policies provides:

Competitive Ads and Services

In order to prevent user confusion, publishers may not display Google ads or search boxes on websites that also contain other ads or services formatted to use the same layout and colours as the Google ads or search boxes on that site. Although you may sell ads directly on your site, it is your responsibility to ensure that these ads cannot be confused with Google ads.

Another provides:

Content Guidelines Publishers may not place AdSense code on pages with content that violates any of our content guidelines. Some examples include content that is adult, violent or advocating racial intolerance.

In other words, Google has significant market power in its core market, and they are using to make no one else gets a foothold. Where you have a choice among Apple products and alternatives, Google cuts off anyone who supports a competitor.

But the “big bad Apple” argument didn’t stop there. Calacanis' piece was validated by Douglas Rushkoff, a guy whose opinion I've respected since he wrote Media Virus which is every bit as relevant today as it was at its release 13 years ago. The Rushkoff piece springboards from the Calacanis article into a world of irony housed in a room of fun house mirrors. Rushkoff uses the anticompetitive argument for a solid "I told you so." "Not only are they anticompetitive today, but they've always been anticompetitive. You guys just were not smart enough to see it."

Jason Calacanis, Web entrepreneur and a longtime Macintosh devotee, this week joined a virtual posse of prominent Internet leaders who now believe Steve Jobs has turned his back on the original promise of Apple to promote creativity and sharing over conformity and restriction.

Jobs never said this. He certainly supports creativity and created environments at both Apple and Pixar which celebrate the creatives over the suits, but Jobs never said anything about being sharing. His greatest skill is identifying talent and getting the best out of them. Not sharing. Apple only looked kind and gentle when Microsoft was its foil.

The funny thing about the argument from Rushkoff, the proponent of free bits and opponent of online abuse is, again, the use of Google Voice as support. An app which gives Google more access than the US Government to your personal data which when combined with your searches, gmail, google desktop and igoogle accounts gives google a better profile of you than the one enjoyed by your spouse. Sure, transcribing your email is nice for you, but don't kid yourself, it is better for Google. Transcribed email can be indexed and becomes searchable and may be cross referenced against the other data, all of which is subject to disclosure. When this kind of access was held by the US Government, the ACLU, and others, went nuts. http://www.pcworld.com/article/17818/does_carnivore_eat_privacy_rights.html

"Carnivore gives the FBI access to all traffic over the ISP's network, not just the communications to or from a particular target," said Barry Steinhardt, associate director of the ACLU. "Carnivore, which is capable of analyzing millions of messages per second, purportedly retains only the messages of the specified target, although this process takes place without scrutiny of either the ISP or a court."

But don’t worry Google says they will do no evil, so there is nothing to be concerned about. Besides, they are completely separate from the government, unless of course this bill goes through:

Probably the most controversial language begins in Section 201, which permits the president to "direct the national response to the cyber threat" if necessary for "the national defense and security." The White House is supposed to engage in "periodic mapping" of private networks deemed to be critical, and those companies "shall share" requested information with the federal government. ("Cyber" is defined as anything having to do with the Internet, telecommunications, computers, or computer networks.)

Getting back to the point. . . . .

Rushkoff hammers the closed argument home.

Still, a walled garden is hardly the image that a technology company wants to have in an age characterized by networking and collaboration. And the products that emerge from a walled garden are more luxury goods than they are suitable for the participation in open platforms. As the Net becomes more about cloud computing, customization, and sharing, the Apple-only solutions will start to become more limiting in ways that people can feel.

If Apple is going to fall victim to its own closed market, why do all these people care? Let it wither and die. But they are writing, because it won’t. Apple’s continued success defies their understanding and upsets the certainties established over the last generation of technology expansion. It makes them uncomfortable, they know AOL died because it was closed and the Web is alive because it was open, but the audience is changing. The world is not so black and white and AOL closed is not the same flavor as Apple’s semi permeable closed. AOL closed meant only content paid for by AOL appeared. Apple closed means the world creates, Apple chooses, and pays for nothing.

We are hearing voices from the generation who watched Apple go from 90 percent market share to 2 at the hands of Microsoft’s “open” system. But this market developed in a very well defined universe of educated business application consumers and computer enthusiasts. The percentage of consumers who would crack open their PC and add hardware was much higher during this period, than it is today. People who owned computers knew what they were doing and they knew what they were buying and installing. When I purchased my first computer in 1978, expandability, compatibility, chip speed and a host of other things were very important in making the decision. The computer was a hobbyist device. People who

bought them opened them up, noodled around and replaced things. Most people wrote at least a bit of code as well. Today, web enabled devices are mainstream products. The consumer does not care about any of those things I did. They want to know what they can do, and whether it will work. That’s all. If I am an expert user, I’ll go to Linux. I can expand it, I can see source, I can talk to a whole community of developers. But if I am a simple consumer, the risks of the open system cause it to pale in comparison to the supervised, walled garden approach of Apple. When we see the mass move into a market, they do not care about things like market expansion they just want something that works. Unfortunately, in a completely open market, that is not what they get. People who know more take advantage of people who know less.

Everyone you ask will tell you they tried a facebook app and accidentally spammed their whole friends list – open platform. Have you ever heard this from someone with an iPhone? Anyone who tries to install a game on a PC will tell you nightmarish tales of driver conflicts and application errors – open system. In the game business, we saw the entire industry collapse around our ankles under the weight of crap games sold to consumers who felt abused – open system - and then rebuilt when Nintendo built its walled garden.

The phenomenon is not unique to technology, Joseph Stiglitz has been trying to get people to understand the impact on the economy for years:

Stiglitz is perhaps best known for his unrelenting assault on an idea that has dominated the global landscape since Ronald Reagan: that markets work well on their own and governments should stay out of the way. Since the days of Adam Smith, classical economic theory has held that free markets are always efficient, with rare exceptions. Stiglitz is the leader of a school of economics that, for the past 30 years, has developed complex mathematical models to disprove that idea. The subprime-mortgage disaster was almost tailor-made evidence that financial markets often fail without rigorous government supervision, Stiglitz and his allies say. The work that won Stiglitz the Nobel in 2001 showed how "imperfect" information that is unequally shared by participants in a transaction can make markets go haywire, giving unfair advantage to one party. The subprime scandal was all about people who knew a lot—like mortgage lenders and Wall Street derivatives traders—exploiting people who had less information, like global investors who bought up subprime- mortgage-backed securities. As Stiglitz puts it: "Globalization opened up opportunities to find new people to exploit their ignorance. And we found them. . . . .

Stiglitz has warned for years that pro-market zeal would cause a global financial meltdown very much like the one that gripped the world last year. In the early '90s, as a member of Clinton's Council of Economic Advisers, Stiglitz argued (unsuccessfully) against opening up capital flows too rapidly to developing countries, saying those markets weren't ready to handle "hot money" from Wall Street. Later in the decade, he spoke out (without results) against repealing the Glass-Steagall Act, which regulated financial institutions and separated commercial from investment banking. Since at least 1990, Stiglitz has talked about the risks of securitizing mortgages, questioning whether markets and authorities would grow careless "about the importance of screening loan applicants." Malaysian economist Andrew Sheng says, "I think Stiglitz is the nearest thing there is to Keynes in this crisis."

The networked world Rushkoff describes is a complex, interrelated ecosystem, much like the economy as a whole. Like the economy, it is a collection of safe and not so safe subsystems interlocking into a worldwide network. Like the world economy, advantage is gained by exploiting inefficiencies. In the financial world, exploiting inefficiencies in information or timing – arbitrage – leads to great wealth. The same can be said in technology. Ev Williams hit it big twice by making it easier first to blog, then to send a short message. But as the systems grow, so does the opportunity for exploitation in a bad way and consumers end up with applications that don’t do what they purport to do. You can watch the migration of applications from useful innovation, to market glut to crap. The uncertainty leads consumers to look for security. Safe, predictable havens are imperative, and prove to be more important than feature set and functionality. Based on the perceived stability of the government and sustained growth of its economy, the US Dollar has been the world currency for many years. As uncertainty arises from key lenders like China, the role as world currency is coming into question. In our smaller much more easily defined world of technology safe havens will prevail over scary wide open spaces.

Jobs drives Apple as a consumer products company - remember when he changed the name to remove "computer" - and he sees the need to guaranty the experience. We turn on a television, toaster and microwave. We don’t boot them up. While the world may accept an occasional – or not so occasional - blue screen and even apologize for shortcomings of their beloved Apple products, they would not accept it from their toaster. Closed is the only way to ensure your computer or phone is as stable as your toaster.

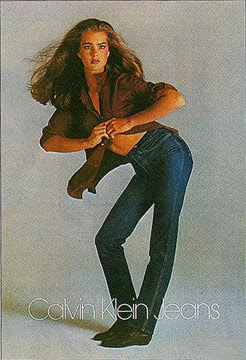

Once stability is ensured, they can enable it do things. Apple sells consumers the ability to do things, not devices. The phrase “There’s an app for that” has become a mainstream joke, but that is exactly the point. When was the last time Dell or Microsoft coined a catch phrase? Just look at the iPhone ads relative to the ads for the Palm Pre. The Pre may in fact be a better device with a more advanced operating system. But if my viewing of Real Housewives of New Jersey is interrupted to look at a new phone what do you think I crave? "You can find a restaurant in your neighborhood, get directions and your friend can still call" or "The Pre has a unique web based operating system that allows you to perform multiple tasks simultaneously." Or worse yet, you show me this one:

that looks a bit too much like this one:

Huh? Please stop. Just give me the one that tells me where to go to dinner and lets me play the driving game with the caveman. If a company builds its brand on the ability to do things, the consumers who buy their products must be able to do them. They have to make sure the applications do what they purport to do and do not threaten other applications and for g-d’s sake, don’t open the hardware.

Like many things undertaken by Apple, the strategy is not for everyone. The beauty of the garden is in the eyes of the beholder. If like Mr. Arrington, the beholder finds no beauty, they will go elsewhere. To a certain extent, we rely on Uncle Steve to give us what we want, even when we don’t know we want it:

The nature of the personal computer is simply not fully understood by companies like Apple (or anyone else for that matter). Apple makes the arrogant assumption of thinking that it knows what you want and need. It, unfortunately, leaves the “why” out of the equation — as in “why would I want this?” The Macintosh uses an experimental pointing device called a ‘mouse’. There is no evidence that people want to use these things. I dont want one of these new fangled devices.

John C. Dvorak, San Francisco Examiner, 19 Feb. 1984

Contrary to Mr. Calacanis’ opinion, Jobs is not a dictator. We elected him with our dollars and put him up for confidence votes regularly. If he doesn’t listen, we can vote him. We’ve done it before. Throughout the nineties, with no Uncle Steve and no network of developers, Apple suffered. And even though Uncle Steve is not always right – the Cube launch – at least Uncle Steve 2.0 reacts quickly – the Cube death. He reacts to the market. When it comes to the iTunes and the app store, Uncle Steve is more Frederick Law Olmstead to New York’s Central Park, than Michelangelo to the Sistine Chapel. He built a garden and invited the world to plant seeds. Like Central Park the form is established but the content will change. Also like Central Park, some content just doesn’t fit and has to be rejected or pruned. So far, it seems Jobs is the guy to do it.

Jobs 2.0’s decisions are driven by long-term concerns over viability and stability of the platform. Do you think it was easy for him to allow an investment from Microsoft when he got back to the company http://www.youtube.com/watch?v=WxOp5mBY9IY? It was an important decision that supported the continued relevance of the platform. Do you really need more proof?

So, here is the dirty little secret. It’s not Rushkoff’s disclosure that Apple is really evil, it is Apple is out to make a profit. At the present time, a walled garden is the best thing for the company. It will continue to operate in the best interest of its consumers, and its long-term viability. If there is conflict between the two, it will favor the company. Some of these decisions may include keeping competitive products off the platform for purely competitive or strategic reasons, but right now and fortunately, consumers have alternatives. If Apple goes too far, it could be 1992 all over again. I won't wait for the thank you card to the game industry for telling them what to do.

Comments