Take Three?: Third Time Is Not Yet a Charm Edition

[I put this up a few weeks ago, and then took it down. I don't know why, so now I am putting it back up. Enjoy.]

A couple weeks ago Take Two announced the termination of takeover discussions with all parties, but it seems the “victory" over the would be invaders is Pyrrhic at best. While the company will certainly survive, whether the actions were in the best interest of the shareholders is up to debate. With the decision to remain fiercely independent seeming set in stone, maybe Take Two will finally move to more fiscally responsible plan than “Rockstar makes all the money and 2K spends it” If last quarter’s events taught us nothing else, we learned GTA’s value has always been factored into the stock price. After the smoke cleared, we see the company is worth roughly the same thing as it was the day Strauss Zelnick entered the board room.

I know all the game stocks are down now, but the most recent USD 380 million plus decline in market value happened before any of the current market wide declines. This could be temporary and there is still time for Mr. Zelnick’s hearty rebuff of EA to prove visionary. It is often hard to tell so close to the events. Actard has been on the ropes a few times in its history and now by some measures it is the largest publisher in the business. Much of the industry thought Yves Guillemot was nuts when he committed so strongly to internal development, and now Ubisoft is widely regarded as the best video game production company in the business. I even had someone tell me the other day history will look at George Bush as a visionary for starting the war on terror. History can create some strange heroes.

But wait a second. I am starting the story in the middle. Let’s take a quick look at Mr. Zelnick’s previous forays into the game business. This is actually his third. Mr. Zelnick left 20th Century Fox, as the boy wonder president of production in 1993 to run Crystal Dynamics. Crystal looked like the place to be. New Media was poised to take over the world and this company was not only tied to the promising 3DO platform, but was funded by the blue chip VC behind 3DO, EA and every other company that mattered before and after 1993. 3DO had just successfully completed the first non biotech IPO of a company with no revenue, significant losses and a soaring stock price. While 57% in the first four days is modest compared to the dot com IPO's it was a big deal in the pre-Netscape days. Crystal was a logical jump for an aggressive guy looking to change the world of media. Unfortunately, through no fault of Crystal or Zelnick, the 3DO platform never took off and Mr. Zelnick and others left the company. Crystal expanded its sku plan to include other platforms and successfully created some franchises. Unfortunately it never created a profit. Eidos acquired the company in 1998 for significantly less than the aggregate venture investment.

Mr. Zelnick then joined BMG as president in 1995, ascending to CEO in 1998. Prior to his joining the company, in 1994, BMG started a game publishing division, BMG Interactive. This was not unusual, in fact it was status quo for record companies. Warner and EMI both started game publishers around this time. They all figured games, distributed on the same media, in the same stores, were a logical progression from music. They all found out they were not. The division was run by Gary Dale, who joined Rockstar as Chief Operating Officer in January 2007, after the departure of founder Terry Donovan. BMG Interactive signed a deal with DMA in March of 1995 and in 1998, the Houser brothers moved over from BMG Music and Donovan from Arista, to form Rockstar Games. Rockstar worked with DMA to create the first Grand Theft Auto. It would be a stretch to think the CEO of BMG, a company with 10 figure annual sales had any day to day interaction with the game division which would barely amount to a parasite on the flea on the tail of the dog which was BMG, but the interactive division, along with Rockstar, was shed under his watch. Again, in fairness, all the other record companies shut the divisions down and wrote off losses rather than selling anything. BMG Interactive, in spite of itself, was actually sold. I say in spite of itself, because I received the pitch from Mike Suarez and Don Traeger when they were trying to sell. The two guys came to my office and showed me the portfolio. GTA 2 was in development and was not significant enough to warrant a place in the presentation dominated by a console port of Paperboy, a marginal snow boarding game and a not even marginal basketball game. GTA only came up in a mention along the lines of "we are also doing another version of that top down PC game Grand Theft Auto.” If the guys selling the company couldn't even see the value of the title how could I ascribe knowledge to the CEO 55 levels above them? It is simply an interesting observation of ships passing in the night.

Last year, Mr. Zelnick, through Zelnick Media, walked into Take Two through the side door. He organized the institutional investors to vote him, and a friendly slate of directors onto the board, thereby ousting the man identified as the worst CEO of a public company in America. At the time, the stock was trading around USD 16, up from the sub USD 10 per share where it spent the previous summer. Zelnick had a plan to turn it around. Over the course of the next year he made some tough decisions, not the least of which was delaying GTA IV. The new blood seemed to have an impact on the market value, and it even started trading up for a few months . . . . until the summer, when it moved right back to where it was when he started. In fact, the biggest increase in the company's market value since Mr. Zelnick stepped in occurred with EA's hostile offer.

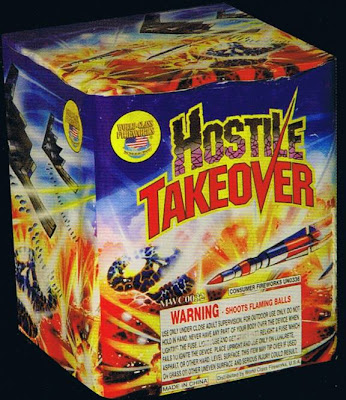

When EA put the offer on the table, the stock jumped from about USD 16 to a hair under what would become it’s 52 week high and a hair above the USD 26 offer price made by EA. Mr. Zelnick immediately went into defensive mode to stop the deal from going through. All of a sudden it was 1987 all over again and Mr. Zelnick started doing his best RJR Nabisco impression as he reached into his bag of defensive strategies. He fought the offer in the media, inserted poison pill stock grants and a bunch of other stuff. The unanswered question is, why? Who was he protecting? Was he thinking the defensive strategies would increase the price of

the company, or did he think the acquisition was not in the best interest of the shareholders? There were a lot of moralistic arguments swirling around the gaming press about how bad it would be for EA to take over the company and I am sure he wanted to protect his employees from what was positioned as an oppressive structure. However, as a CEO, he can’t worry about those things. He has a fiduciary obligation to act in the interest of the shareholders and the company and he was presented with an offer containing a USD 776 million premium over the company’s market value the day before. He had to work to maximize the value of the company and if a sale was the best option, he had to maximize the price of the sale. His response, calling the offer “opportunistic” and saying it “. . . substantially undervalue[d] Take-Two’s robust and enviable stable of game franchises, exceptional creative talent and strong consumer loyalty” make it sound like the he doesn’t think the offer is high enough. Neither did his advisors, Bear Stearns and Lehman Brothers - really. Were they looking at the same slate as the rest of us? Theirs included games like Spec Ops, Red Dead Revolver, Manhunt, are any of these still alive?

the company, or did he think the acquisition was not in the best interest of the shareholders? There were a lot of moralistic arguments swirling around the gaming press about how bad it would be for EA to take over the company and I am sure he wanted to protect his employees from what was positioned as an oppressive structure. However, as a CEO, he can’t worry about those things. He has a fiduciary obligation to act in the interest of the shareholders and the company and he was presented with an offer containing a USD 776 million premium over the company’s market value the day before. He had to work to maximize the value of the company and if a sale was the best option, he had to maximize the price of the sale. His response, calling the offer “opportunistic” and saying it “. . . substantially undervalue[d] Take-Two’s robust and enviable stable of game franchises, exceptional creative talent and strong consumer loyalty” make it sound like the he doesn’t think the offer is high enough. Neither did his advisors, Bear Stearns and Lehman Brothers - really. Were they looking at the same slate as the rest of us? Theirs included games like Spec Ops, Red Dead Revolver, Manhunt, are any of these still alive? Take Two’s product line looks kind of like the theme song from the first season of Gilligan’s Island. I can almost hear the theme song playing him my head as I think about the strong points of the company. There’s GTA, Midnight Club, and the rest. Sure Bioshock is important, but so are the Professor and Maryanne. Bioshock is a rounding error at EA and Actard, and until the sequel, it remains somewhat unproven. Take Two without GTA is Eidos. Take Two without Rockstar is Midway. Go ahead, do the math, you’ll see. The market did. When the initial offer was made by EA, GTA was on the horizon. Even though EA said it would not able to take advantage of the revenue, if the deal was done quickly, the acquirer could book the revenue, at the very least, they would get a hold of the company while the coffers were full. Once GTA is released, not only is the unlimited upside potential crystallized into a certainty, the release represents the last cash windfall for a number of years. But Mr. Zelnick must have seen this. So why did he really stall?

As a simple guy looking from the outside in, but based on the market’s reaction to EA’s decision to withdraw the offer, it looks like Mr. Zelnick was wrong. At the time, the company was not worth more than EA offered, and in fact, it is not even worth as much. If it were, it would be sold. The stalling seemed to be a combination of ego and brinksmanship. While it worked in the Cuban Missile crisis, the outcome here was more Bay of Pigs. The difference between those two events was research. In this case, there seemed to be none.

First, and perhaps most significantly, he should have known he would not get a higher offer out of EA. Looking at John Riccitiello’s history, his first offer is usually his best, and his last. We saw it played out publicly in the case of Eidos, and a few others. With Owen Mahoney backing him up, the offer was based on EA’s determination of Take Two’s value to EA. They will let the deal fall through before they overpay for something. By stalling the negotiation, it doesn’t seem Mr. Zelnick knew this.

Mr. Zelnick stalled the process while he generated interest from others in the wings. This could be considered the responsibility of the CEO. It appears he thought the EA offer would establish a minimum value for him to use in discussions with other suitors. Unfortunately, he did not realize the company had unique value to EA at a specific point in time. He found other suitors in fact, these discussions were on-going on August 19th when EA agreed to drop its hostile bid and enter into negotiations with the company. I believe in Mr. Zelnick’s mind, he thought the EA meeting would go something like this:

“Nice to see you John” with a firm handshake.

“Strauss” Riccitiello replies.

“How’s the family?”

“Doing well, yours?”

“Great thanks. Now that we have the NDA in place, I can tell you, we have offers of USD 30, USD 35 and USD 40 per share for the company. If you are interested in matching those, we’d love to hear it. Otherwise, nice to see you.”

“Of course we are. We’ll give you USD 45.”

Unfortunately, it didn’t really happen quite that way. The other offers never materialized. There were just discussions. I wish I was a fly on the wall, but after the long diligence session, and in the midst of other discussions which were not generating significant enough offers to do a deal, it probably went something like this:

“Nice to see you John” with a firm handshake.

“Strauss” Riccitiello replies.

“Well?”

“Strauss, we’ve looked at the books and analyzed your products, your production pipeline and your distribution reach. We’d like to revise our offer. . . “

“Great!” looking up at John

“down.”

“What?“

“We can’t justify the offer any more.”

and the stalking horse left the room. . . In fact, the stalking horse left the whole farm. The value to EA came and went. It moved from a “have to have” to “nice to have.” Nice to have’s aren’t worth as much. EA announced its termination of discussions, and we learned the increase in value over the previous months was not attributable to anything undertaken by Take Two when the market value returned but to just below the trading price on the day before the first EA announcement was made. The decline made Mr. Zelnick’s earlier statement of being vindicated by the sales of GTA IV http://bits.blogs.nytimes.com/2008/04/29/grand-theft-auto-iv-and-real-world-billions/?partner=rssuserland&emc=rss look a lot like President Bush’s Mission Accomplished speech on the deck of the carrier.

Now we can use the hindsight which was unavailable to Mr. Zelnick during the discussions to determine whether this was the right idea. Can Take Two survive as a separate entity? Of course. It is still a USD billion company. Is it going to be a lot harder for them to survive, of course. The company grew when games cost between USD 1 and USD 5 million and today games cost significantly more. The higher cost of games makes it harder for the company to compete against the bigger players. Moreover, the smaller slate makes it more difficult to secure and maintain shelf space in a highly competitive market. Is the shareholder value going to be maintained – not so certain. The real world has always placed a higher multiple on EA and recently extended the treatment to Actard. In the eyes of Wall Street, there is EA, Actard and some other publishers. As we move forward, this credibility gap will likely grow. Stock prices are not only driven by revenue, but by the impressions of institutional investors. They like steady and predictable slates. The only prediction Take Two can make is GTA will sell a lot. Compare that to a "Madden," "Guitar Hero" and "Call of Duty" every year. Not to mention so WOW revenue. The market value is important because it is the measure of the cost of capital. The company's life blood in the cold war of ever increasing budgets we call game development today. EA may not have been the best choice in the long run, but it definitely had the deepest pockets.

From a creative perspective I have to admire the commitment to stay independent, but the institutional investors who installed Mr. Zelnick did not bring him in to establish a new high point in creative game making. From a business perspective, I have wonder whether it was right to walk away from a sale at roughly USD 760 million profit for the shareholders in just over a year‘s presence in the board room. I wish him, and the company the best of luck. In this business, he is only a few hits away from making a hostile offer to acquire EA. Then I will eat my words.

Comments