More Irrelevance Warning: Foreshadowing Edition

Sometimes everyone is thinking the same thing as I am and other times, I just notice the references more because I am thinking about it. I don't know which one is happening now, but the New York Times seems to be saying the same thing about Harley Davidson as I wrote about the game business. It just seems like we could substitute Harley with the name of any one of the console publishers and the story would still be accurate. They are just further along the curve. The consensus on Harley is they must change or die.

I added the emphasis. You can read the whole article here.

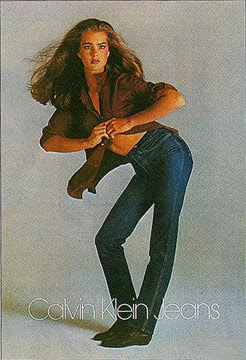

. . . But Harley persevered by capitalizing on its revered brand, made famous in movies like “Easy Rider,” and more recently by appealing to boomers’ desire to recapture their youth. . . .

By building such a powerful brand with offbeat, behind-the-scenes efforts — little advertising, lots of accessories and minor visible changes to bikes over the decades — Harley has become a case study for academics, marketing gurus and other corporations. But Harley’s longtime strategy of marketing to the boomers, which was a blazing success, is now backfiring.

Its core customers have grayed, and they are buying new bikes less often. The average age of a Harley rider is 49, up from 42 five years ago. But company executives don’t seem outwardly worried by the lackluster growth among those 35 and younger, even as it takes steps to turn them into Harley owners.

They say they’re confident that the baby-boom generation has 15 more years of riding life. “They’re not about to stop riding because they’re getting older,” Mr. Richer says. “It would be dumb to walk away from our core customer, the most lucrative customer.”

As Harley keeps most of its focus on its aging consumers, rivals like BMW, Honda and Yamaha are attracting younger customers who seem less interested in cruising on what their old man rides. United States sales of light sport bikes, intended for the younger crowd, have increased more than 50 percent in the last five years, and the Japanese makers have popular cruisers of their own. Harley has roughly 30 percent of the overall United States motorcycle market, but it accounts for half of the heavyweight bikes sold in America. . . .

“Harley understands the baby-boomer consumer incredibly well, in a holistic sense,” says Gregory Carpenter, a marketing professor at the Kellogg School of Management at Northwestern. “But to grow and thrive, they must create a deep emotional connection with younger consumers.”

Comments